Identity theft prevention and protection

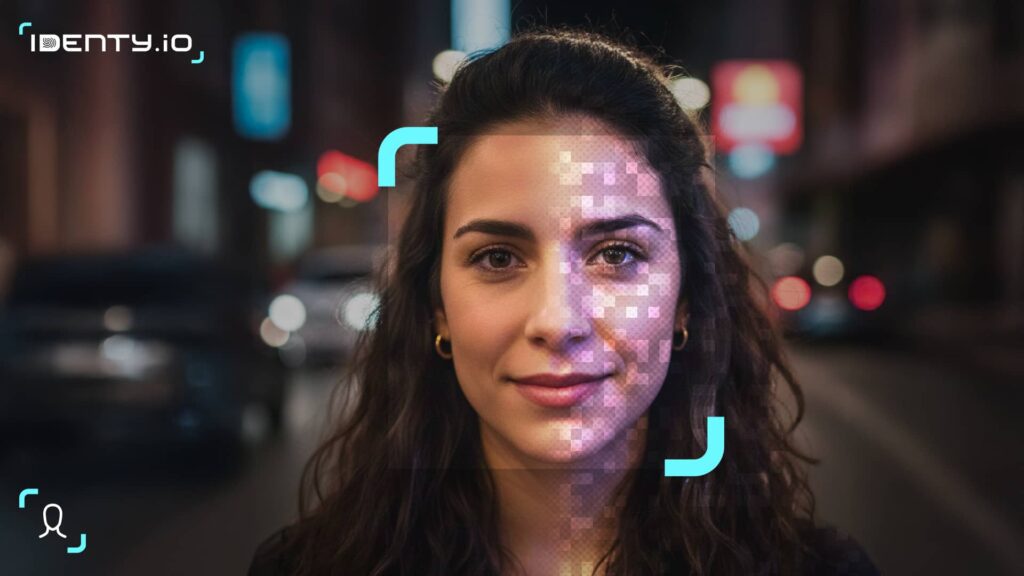

Digital identity theft prevention and protection Identity theft remains a growing threat for financial and government services, challenging digital trust and user experience. In 2024 U.S. authorities received over 1.1 million identity-theft reports, underscoring the scale of the problem. New fraud patterns (e.g. tax-refund schemes, synthetic identities, AI-driven deepfakes) demand advanced solutions. This report examines risk trends and regulatory context, and outlines a layered defense strategy: strong biometric authentication, real-time fraud analytics, and user-centric protections (like credit monitoring and insurance). For example, Identy.io (a FIDO Alliance member) offers a touchless mobile biometric platform with built-in liveness checks, illustrating how modern identity