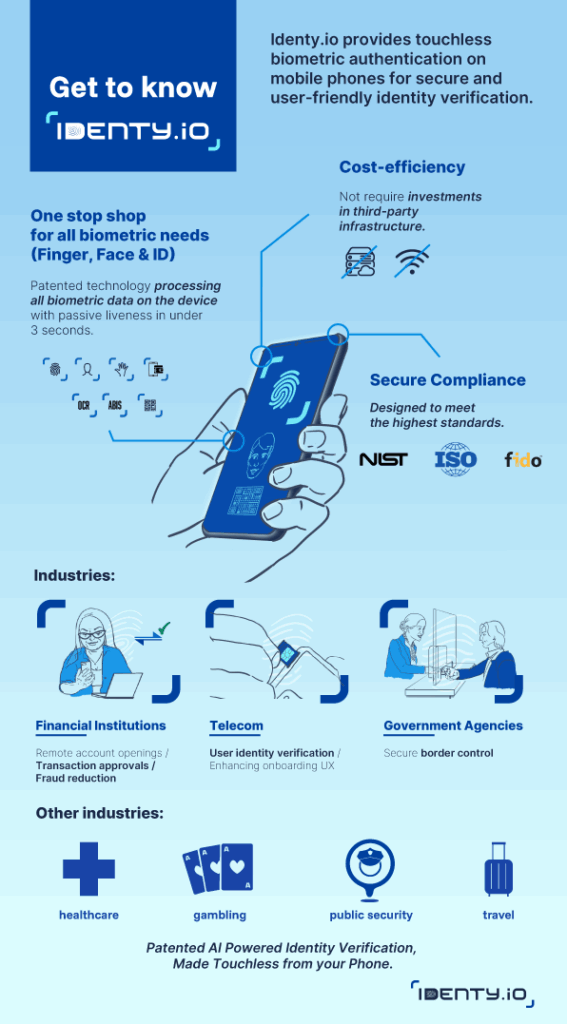

Identy.io obtains MOSIP certification and its cutting edge biometric solutions are now available on its marketplace

The Identy.io’s enterprise-grade ABIS solution, with support for both fingerprints and facial features, has already been validated by MOSIP and is now available for governments that are implementing digital identification programmes based on the platform offered by the international entity. MOSIP (Modular Open Source Identity Platform) is an open-source framework