Table of Contents

ToggleAs digital identity verification becomes critical in banking, fintech, and e-government, the future of Know Your Customer (KYC) lies in multimodal biometrics. This means using multiple biometric factors (like face, fingerprint, or voice) along with advanced AI techniques to verify identities. The goal is to balance a frictionless user experience with ironclad security. Demand for digital identity checks is soaring, global identity verifications are projected to exceed 70 billion in 2024, up from 61 billion in 2023. To stay ahead, organizations are embracing biometric KYC solutions such as Identy, a leading multimodal platform, to streamline digital onboarding, boost conversion rates, and combat fraud. Key innovations like passive liveness detection, anti-spoofing defenses, and on-device AI are making remote identity proofing both seamless and secure. In this article, we explore how multimodal biometric KYC enhances user experience, conversion, security, and scalability for forward-thinking enterprises.

UX and conversion in biometric KYC

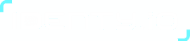

In customer onboarding, user experience (UX) can make or break conversion. Lengthy or cumbersome identity checks often lead to abandonment, in fact, a friction-filled KYC process can cause up to 68% of users to quit signing up. This translates to billions in lost revenue. The future of KYC demands frictionless onboarding that keeps users engaged while meeting compliance. Biometrics offer a fast, intuitive way to verify identity: customers simply look at a camera instead of slogging through forms or in-person verification.

Passive liveness detection is a game-changer here. Unlike older “active” liveness tests that ask users to blink or move (introducing awkward friction), passive liveness works silently in the background. The system analyzes a selfie or short video in real time for subtle signs of life, things like natural skin texture, micro-movements, and light reflections, to confirm the person is real. Because no user gestures are required, the process feels effortless. “Our passive liveness detection removes the need for user gestures, delivering a frictionless verification experience in under a second-even under poor lighting” explains Identy’s team. This invisible check boosts completion rates: even non-tech-savvy users find it intuitive, and they aren’t interrupted by prompts or delays. For businesses, smoother UX directly means higher conversion and retention.

Importantly, consumers are embracing biometrics. 81% of users now see biometrics as more secure than passwords, and 72% globally prefer facial recognition over traditional logins. By offering a login or onboarding flow that “just works” with a selfie, companies build trust and reduce drop-offs. Identy.io’s mobile-first approach is a prime example, it lets bank or fintech customers verify their identity by simply taking a selfie on any smartphone, with AI doing the rest on-device. Identy’s platform, used by banks and telecoms for remote account opening, “reduces friction, limits abandonment rates, … and enables digital fraud prevention, all while enhancing the user experience.” In short, a well-designed biometric KYC process maximizes conversions by making security feel easy.

Security reinforced by liveness detection and anti-spoofing

Beyond convenience, the future of KYC depends on robust security against increasingly sophisticated fraud. Biometric verification must ensure the person behind the screen is real and not an imposter using someone else’s photo, video, or a AI-generated deepfake. This is where liveness detection and anti-spoofing measures become critical. Liveness detection acts as a digital bouncer, checking that a live human face or fingerprint is present and not a fake representation. Modern passive liveness algorithms look for dozens of hard-to-fake cues (e.g. 3D depth, dynamic skin patterns) that a static image or mask cannot replicate. If anything seems off – a telltale flatness of an image or a slight lag from a video – the system flags it and stops the verification.

Today, passive liveness is emerging as the gold standard for both security and UX. It quietly analyzes biometric signals at lightning speed, typically adding no perceptible delay. This approach is also more resilient to spoofs than active methods. As cybersecurity experts note, deepfake technology can already mimic simple actions like blinking, but “replicating the nuances of a real human face in real time, like skin texture, depth, and light behavior, is still extremely difficult. That’s where passive liveness shines.” By catching forgeries that humans might miss, passive liveness dramatically improves fraud resistance without any user effort.

Leading providers like Identy build multi-layered fraud prevention into their KYC solutions. For example, Identy’s AI performs liveness checks and matches a selfie to the photo ID to ensure the person is both present and the true owner of the ID. Identy’s system is certified compliant with ISO 30107-3 anti-spoofing standards (PAD Level 1 & 2) and blocks spoofing attempts from photos, masks, or deepfakes. These anti-spoof defenses have real impact: in one case study, adding a selfie liveness check cut identity fraud by 78% in a digital onboarding pilot. Moreover, by leveraging multimodal biometrics, organizations can double up on security, for instance, requiring both face and fingerprint verification for high-risk actions. It’s far harder for a fraudster to fake multiple biometrics at once. All these measures reinforce trust: financial institutions and government agencies can confidently know that the person on the other end of a remote onboarding session is genuinely who they claim to be. The result is strong security that doesn’t rely on heavy-handed user steps. As passive liveness and AI-driven anti-spoofing become mainstream, we’re effectively future-proofing KYC against even AI-driven fraud attempts.

Scalability and future-readiness of multimodal KYC

The next-generation KYC solutions must not only be user-friendly and secure, but also scalable to handle millions of verifications efficiently. This is especially true as digital banking and e-government services grow. In 2024, banks alone are expected to conduct 37 billion identity verification checks (over half of all global checks), a staggering volume that demands high-performance systems. Multimodal biometric platforms like Identy are built for this scale. Identy’s architecture performs all biometric processing on the user’s device, leveraging the computing power of smartphones at the edge. This design greatly reduces load on servers, cuts latency, and even enables offline verification in remote areas. In practice, whether an organization is verifying hundreds or millions of users, the experience remains fast and reliable. “With touchless biometrics and remote authentication that works even without internet access, Identy.io eliminates friction while delivering corporate-grade security,” the company notes. By minimizing dependence on network conditions and cloud infrastructure, such solutions ensure consistent service at scale.

Scalability also means adapting to various use cases and maintaining performance across them. Multimodal biometric KYC can be deployed for everything from fintech apps onboarding new customers to national eID programs verifying citizens. In government, adoption of biometrics is already high, an estimated 70–85% of governments use facial, fingerprint, or iris biometrics for ID programs, border control, and social services. These large deployments require systems that are interoperable with existing databases and comply with strict regulations. Identy, for example, meets global standards like NIST and FIDO2, and is used by banks, telecom providers, and public institutions across Europe, Latin America, and the U.S. Its multimodal capability means organizations can choose the biometric mode best suited to each context (facial recognition for mobile onboarding, fingerprint for ATMs or border kiosks, etc.), all through one unified platform. This flexibility at scale leads to better coverage and convenience.

Crucially, the focus on passive liveness detection ties into scalability by optimizing conversion and accuracy even as volumes grow. By silently filtering out fake attempts in real time, passive liveness reduces the need for manual review or secondary checks, enabling KYC workflows to scale without adding friction. It’s no surprise that over 65% of leading fintechs now require liveness checks as part of onboarding, the industry recognizes that you cannot scale digital services safely without these advanced checks. Passive liveness, in particular, is “fast becoming the industry standard for both security and user experience.” For organizations prioritizing growth, a multimodal biometric KYC solution with passive liveness offers an attractive trifecta: high conversion, high security, and the ability to grow without bottlenecks.

Embracing a multimodal biometric future

The future of KYC is taking shape at the intersection of innovative biometrics and business strategy. Multimodal biometric KYC solutions like Identy’s are proving that user experience and security can advance hand in hand. With passive liveness detection operating behind the scenes, users enjoy fast, simple onboarding while fraudsters are quietly kept out. This translates to higher customer conversion rates and stronger fraud prevention, a win-win for companies and customers alike. Just as important, these solutions are built to scale, bringing frictionless verification to billions of interactions whether in banking apps or national eID systems. By investing in biometric liveness detection, anti-spoofing, and flexible multimodal tech, organizations position themselves for a digital identity landscape that demands both trust and ease.

In an era of rising cyber threats and sky-high user expectations, embracing multimodal biometrics is becoming not just an option but a strategic imperative. A seamless selfie login that simultaneously thwarts imposters can significantly boost onboarding success and customer trust. Forward-looking CMOs and digital identity leaders in finance and government are already moving this direction, and those who haven’t will likely follow, as passive liveness and AI-driven KYC become the norm. The writing on the wall is clear: to build the next generation of customer onboarding and e-government services, frictionless biometric verification will be the key. By choosing leading-edge partners like Identy, organizations can stay ahead of the curve, delivering conversions and security at scale. The future of KYC will be defined by experiences that are as smooth as they are secure, powered by multimodal biometrics that quietly ensure every user is both who they claim to be and very much alive.

- Biometric Update – Passive liveness detection and intelligent friction keep remote fraudsters away. (Oct 2024)

- Biometric Update – Blurred line between deepfakes and reality opens door to invasive fraud. (Jun 2025)

- Biometric Update – Arsenal for deepfakes and injection attacks continues to grow. (Sep 2025)

- Biometric Update – Hacks cause Login.gov to advance digital ID verification through remote proofing. (May 2025)

- ENISA – ENISA Threat Landscape 2025. (Nov 2025)

- ENISA – Threat Landscape (topic hub, incl. ETL 2024 overview)

- NIST – Face Recognition Vendor Test (FRVT)

- World Economic Forum – A Blueprint for Digital Identity (PDF)