Table of Contents

ToggleBiometric identification in banking and fintech has become one of the most secure and efficient tools. Face and fingerprint recognition technologies are reshaping how financial institutions verify identities, prevent fraud, and authenticate users bringing convenience and compliance together.

For companies like Identy.io, which in 2024 deployed its fingerprint biometric solution to eliminate branch visits during onboarding, this shift marks a milestone toward fully digital and secure financial services.

Biometric identification in customer onboarding

Remote KYC and digital identity verification

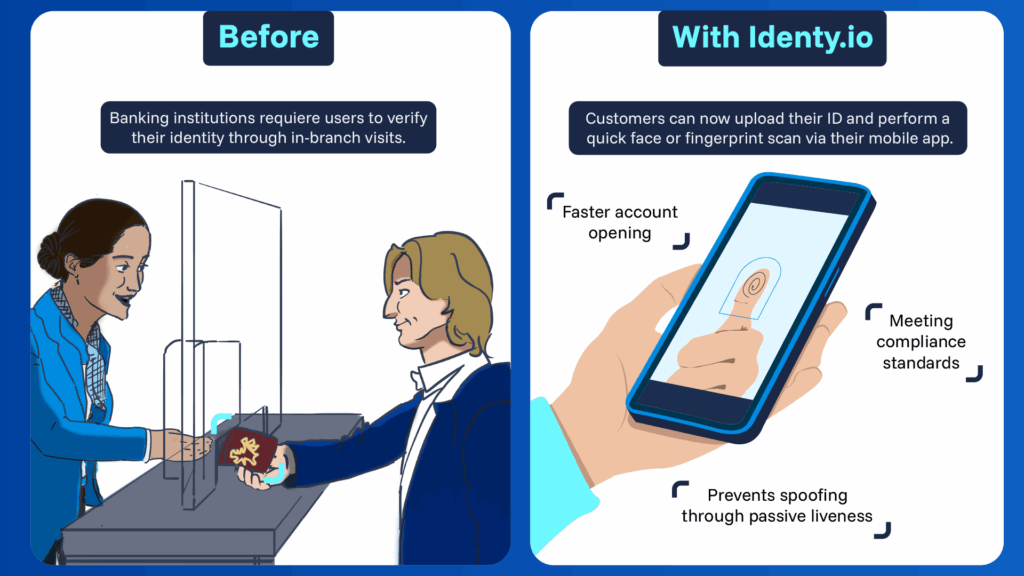

Banks and fintechs are transforming Know Your Customer (KYC) procedures through biometric onboarding. Instead of requiring in-branch visits, customers can now upload their ID and perform a quick face or fingerprint scan via their mobile app.

This live verification process confirms identity in seconds while meeting strict AML (Anti-Money Laundering) regulations. For instance, Banco Popular Dominicano integrated Identy.io’s technology to validate fingerprints remotely streamlining access to banking for thousands of users.

Main benefits

- Speed: Accounts opened in minutes, not days.

- Security: Liveness detection prevents spoofing with photos or videos.

- Inclusion: Enables people without easy branch access to verify identities securely.

Biometric onboarding reduces friction for users while allowing banks to maintain strong compliance standards.

Fraud prevention through biometrics

Fighting impersonation and synthetic fraud

As fraudsters leverage deepfakes and stolen data, banks turn to biometric verification to detect impersonation and synthetic identities. By comparing real-time facial or fingerprint data against government or proprietary databases, institutions can verify that each user truly exists.

According to industry reports, synthetic identity fraud could cost over $20 billion annually by 2030. Biometric systems help detect anomalies early by confirming that a real person, not an AI-generated replica, is behind each transaction or onboarding session.

Fighting impersonation and synthetic fraud

Beyond static checks, some institutions implement behavioral biometrics such as typing rhythm or touchscreen pressure to detect suspicious patterns during sessions. These systems flag deviations instantly, providing a second layer of protection without disrupting user experience.

Benefits

- Reduces fraud attempts and chargebacks.

- Enhances regulatory compliance for KYC/AML.

- Builds consumer trust through transparent identity control.

By combining face, fingerprint, and behavioral biometrics, banks create a robust multi-factor ecosystem resistant to impersonation attacks.

Authentication: beyond passwords

Seamless and secure access

In day-to-day banking, biometrics are now a primary authentication factor. Users log into their banking apps or authorize payments using Face ID or fingerprint scans, eliminating passwords altogether.

Major banks such as Wells Fargo, HSBC, and OCBC have adopted biometric logins, while fintechs like Revolut and Monzo rely on facial verification during registration and high-risk actions.

This shift aligns with the PSD2 “Strong Customer Authentication” standard, which recognizes biometrics as a compliant verification method.

Advantages for Customers and Banks

- Faster and frictionless logins.

- Reduced password fatigue and recovery costs.

- Stronger defense against phishing and credential theft.

For mobile-first institutions, biometric authentication enhances both security and usability a key differentiator in the competitive fintech space.

Trends and regulatory Context

Between 2023 and 2025, biometric adoption in banking has surged globally. Reports indicate that 40 % of banks now use physical biometrics for fraud prevention, up from just 26 % five years ago. Spending on digital identity solutions is projected to exceed $80 billion by 2028.

At the same time, privacy and compliance remain top priorities. Under the EU GDPR and U.S. BIPA, biometric data qualifies as “sensitive information,” requiring explicit user consent and secure storage. Most banks now keep biometric templates encrypted or stored locally on the user’s device, minimizing privacy risks.

This balance between security, convenience, and transparency defines the next frontier of biometric innovation in finance.

The future of banking Is biometric

As fintech ecosystems mature, biometric identification will underpin every stage of the customer journey from onboarding to daily authentication. Technologies like those offered by Identy.io demonstrate how face and fingerprint recognition can make financial services safer, more accessible, and fully digital.

In a landscape where trust and speed define success, biometrics are not just a security upgrade they are the new foundation of digital identity.

Bibliography

- Deloitte (2023). The role of biometrics in fraud prevention in financial services.

- Statista (2023). Digital identity market size and banking biometrics adoption.

- Finextra (2022). How digital KYC is transforming customer onboarding.

- Techmagic (2024). Biometric authentication in fintech: trends and best practices.

- Aware Inc. (2024). Global biometric authentication survey.

- EU General Data Protection Regulation (GDPR) – Articles 4 and 9.

- U.S. Biometric Information Privacy Act (BIPA), Illinois (2008).

- Association of Certified Fraud Examiners (2024). Banking fraud trends report.

- OCBC Bank (2023). Face recognition ATM integration via SingPass.

- Identy.io (2024). Fingerprint biometric integration for remote identity validation.