Table of Contents

ToggleBiometric identity verification is poised for another leap in 2026, driven by a dual mandate: seamless user experience and uncompromising security. Digital onboarding has gone mainstream in fintech, banking, and e-government, with biometrics (like face or fingerprint ID) at the core of verifying “you are who you claim to be.” Global adoption of these technologies is accelerating, for example, the market for face biometric liveness checks is projected to more than double from 2025 to 2027. As organizations strive to onboard users remotely without losing them in the process, a key theme has emerged: the rise of passive liveness detection as the new gold standard for balancing high conversion rates with fraud prevention.

The UX imperative: Frictionless onboarding in 2026

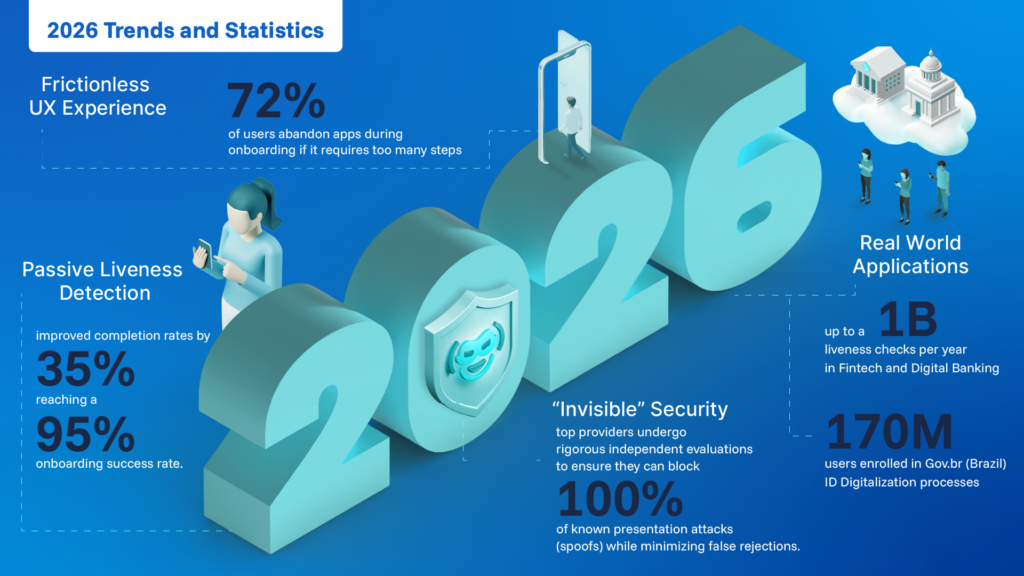

In the digital era, user experience (UX) can make or break a service, especially during onboarding. Businesses have learned that excessive steps or security hurdles can turn users away in seconds. In fact, one survey found 72% of users abandon apps during onboarding if it requires too many steps. This is a sobering statistic for growth-focused teams: every additional pinch, blink, or “retry” screen risks losing a customer. Traditional active liveness checks, which ask users to perform actions like “blink now” or “turn your head to the left”, are a prime example of such friction. They interrupt the sign-up flow and often frustrate users with awkward instructions or repeat attempts. It’s no surprise that these active liveness systems have been a primary cause of users abandoning the onboarding process. One biometric provider even found completion rates for its active liveness method were lower than desired, prompting a redesign to improve the user experience.

The industry’s answer is passive liveness detection, a behind-the-scenes check that runs without any extra action from the user. With passive liveness, the user simply takes a selfie as usual, and the system analyzes subtle cues like skin texture, lighting, depth and micro-movements to confirm they are a live person. There are no special prompts to follow; the liveness test happens in an instant, invisible to the applicant. The result is a frictionless experience that feels just like a normal selfie step, dramatically reducing drop-off. This shift from active to passive liveness can have a direct payoff in conversion: in one real-world banking case, moving to a seamless passive liveness process improved completion rates by 35%, reaching a 95% onboarding success rate. Passive liveness, as one industry analysis described it, is “frictionless to users while being spoof-proof,” combining convenience with security. In 2026, organizations focused on growth are overwhelmingly favoring this approach to keep customers happy without sacrificing fraud defenses.

Securing digital identity: Fraud prevention meets scalability

Hand in hand with user experience is the need for robust security. Fraudsters haven’t been idle, they are using more advanced tools, including AI-driven deepfakes, to try and trick biometric systems. The past couple of years have seen an explosion in these threats: the number of deepfakes detected worldwide quadrupled between 2023 and 2024, and global losses from identity fraud climbed over $50 billion in 2024 (growing more than 20% year-over-year). This wave of sophisticated attacks (from presenting high-resolution photos or masks to injecting synthetic video streams straight into an app) exploits any weakness in remote verification. The message to organizations is clear: identity proofing must be airtight. If a bank or government platform cannot reliably tell a live user from a fake, the door is open for fraud, account takeovers, and reputational damage.

Liveness detection has emerged as the crucial gatekeeper against these attacks. It works by verifying that there is a live human present during a biometric check, stopping spoofers who might use a photo, a video playback, or a deepfake instead of a real face. Both active and passive liveness serve this security purpose, but the passive approach offers protection without the trade-off in UX. Modern passive liveness systems use AI to examine characteristics that are extremely hard to fake (for example, the natural reflectivity of living skin or involuntary micro-blinks), all in real-time. Importantly, these systems are now proven and tested: top providers undergo rigorous independent evaluations (like ISO 30107-3 compliance testing by labs such as iBeta) to ensure they can block 100% of known presentation attacks (spoofs) while minimizing false rejections. In other words, passive liveness has matured to a point where it can catch fraud and keep honest users moving forward.

Regulators and industry standards are also elevating liveness to a non-negotiable status. The U.S. National Institute of Standards and Technology (NIST), for example, now requires liveness detection in remote identity proofing to ensure the photo being verified is “live” and not a spoof. Gartner analysts likewise affirm that any modern digital identity verification process must include integrated liveness detection alongside document and biometric checks. In practice, this means banks, fintechs, and government agencies in 2026 are increasingly mandated to have liveness protection in their onboarding and authentication workflows. Many have responded by choosing passive liveness as the default because it strengthens fraud prevention without adding friction. When done well, a passive liveness check significantly reduces the risk of fake identities slipping through (preventing huge fraud losses) while operating so smoothly that legitimate users hardly notice it. It’s a win-win that enables both security at scale and user-friendly growth.

Passive vs. active liveness: The new standard for 2026

As the industry evolves, a clear consensus is forming: passive liveness is becoming the preferred approach for organizations that value both high conversion rates and rigorous security. It’s useful to break down why passive liveness is outshining the older active techniques:

- Active Liveness (Legacy Approach): Requires explicit user actions (e.g. blinking, smiling, turning head on command). These visible challenges can provide a sense of security, but they add friction at every step, each prompt is another chance for user error or drop-off. Active methods can also create accessibility issues (not everyone can perform the requested movements easily) and may be vulnerable to replay attacks with pre-recorded videos. In short, active liveness is like a strict gatekeeper, it can stop bad actors, but at the risk of turning away some good users too. In 2026, this approach is increasingly seen as outdated and cumbersome for most consumer-facing applications.

- Passive Liveness (Modern Approach): Runs silently in the background during a face scan or selfie capture. No special actions are required from the user beyond looking at their camera normally. Advanced AI algorithms analyze dozens of signals, from 3D depth and skin translucence to subtle facial movements, to confirm the person is physically present and not a spoof. This all happens in a split second, often using a single frame or a short video, without interrupting the user’s flow. The experience feels identical to a standard selfie step, making it frictionless and inclusive (users of all abilities and literacy levels can succeed). Yet behind the scenes, passive liveness can be extremely robust, catching advanced fraud that active methods might miss. Think of passive liveness as a smart invisible shield, strong security that doesn’t slow people down. It delivers a seamless UX with no sacrifice in security, which is exactly what organizations want in 2026.

It’s therefore no surprise that passive liveness has become a foundational technology for digital identity verification. As one industry expert noted, it ensures security is transparent (invisible to the user), accessible to everyone, and it maximizes user adoption by removing needless hurdles. Many fintech firms and digital banks now start with passive liveness for all users to keep onboarding smooth, only falling back to any active checks in exceptional high-risk cases. Even biometric vendors themselves have pivoted this way: several are phasing out or augmenting their active liveness offerings after seeing customers demand more user-friendly solutions. The overall trend for 2026 is clear, passive liveness is becoming the new standard, while active liveness is reserved mainly for backup or niche scenarios that might require an extra layer.

Real-World applications: From fintech to government

The dominance of passive liveness isn’t just theoretical; it’s playing out in real-world deployments across industries:

- Digital Banking & Fintech: Banks and fintech startups have widely adopted passive liveness to verify new customers during remote digital onboarding and to authenticate logins or high-value transactions. The business impact has been significant. By removing gimmicky selfie tasks and switching to invisible liveness checks, companies have seen more users complete the sign-up process and fewer false declines. As noted earlier, some institutions achieved completion rates of 95% for online onboarding by using passive liveness with document verification. Importantly, security remains strong, fraud rings that attempt to use stolen IDs or deepfake videos are stopped in their tracks by liveness checks. Industry reports show that leading providers are now performing up to a billion liveness checks per year for clients in sectors like finance, crypto, and dating apps, underscoring how commonplace the technology has become. Banks also appreciate that passive liveness helps meet strict KYC/AML compliance requirements (since regulators want to see that a real customer was present during onboarding) without driving away customers with clunky processes.

- Government Digital ID & e-Government: Government agencies around the world are rolling out digital identity programs and online citizen services, from mobile driver’s licenses to national ID apps. Here, too, passive liveness is playing a pivotal role. Public-sector digital ID systems need to be highly secure (to prevent fraud in services like benefits or voting) but also inclusive so that citizens of all ages and abilities can use them. Passive liveness fits the bill perfectly. For example, Brazil’s Gov.br platform, one of the largest digital government ecosystems, uses facial biometrics with passive liveness to authenticate users for thousands of services. The result has been stunning adoption: Gov.br has enrolled roughly 170 million users, digitized 92% of federal services, and saved billions annually, all by enabling convenient yet secure access via a unified digital ID. Officials credit the platform’s success in part to its frictionless UX and strong biometric security, which have built public trust in the system. Likewise, many other governments are following suit. In the EU, upcoming electronic ID wallets are expected to incorporate passive liveness checks to meet high assurance levels. And in the U.S., the federal Login.gov service learned the hard way that skipping liveness was a mistake, after facing fraud issues, they have moved to add liveness detection to meet security guidelines. Across the board, passive liveness is becoming a standard component of e-government and digital public services, ensuring that only real, live citizens gain access while keeping the user experience as simple as taking a selfie.

Looking ahead in 2026

As we head into 2026, biometrics and digital verification are entering a new phase marked by smarter technology and more strategic deployment. Organizations no longer have to choose between maximizing security and delivering a smooth user journey, approaches like passive liveness detection prove that you can have both. This year will likely see passive liveness solidify its dominance in remote identity verification, reinforcing trends of higher conversion rates and lower fraud across fintech, financial institutions, and government programs. User experience will continue to be a competitive differentiator, meaning solutions that offer “invisible” security (low-friction, AI-driven checks) are set to thrive. Meanwhile, fraud prevention remains an ongoing battle: the industry will keep evolving liveness detection, AI-driven biometric matching, and even behavioral analytics to stay ahead of deepfakes and sophisticated attacks.

For CMOs and CTOs planning their digital identity and onboarding strategies, the writing on the wall is clear. Embracing passive liveness and related biometric advancements is fast becoming a best practice, one that can unlock higher customer acquisition, greater trust, and compliance with emerging regulations. By adopting these 2026 trends in biometrics and digital verification, organizations can scale up their services confidently, knowing that they are providing a frictionless yet secure experience. The convergence of UX and security through technologies like passive liveness is not just a trend, but a fundamental shift: it enables a future where proving who you are online is both effortless for users and foolproof against fraudsters. In the coming years, we can expect digital identity verification to become even more seamless (perhaps continuous or fully in the background), but its success will rest on the strong foundations laid now, the strategies that put the user first while rigorously verifying that each digital interaction is trustworthy and genuine.

- Biometric Update – Carla Roncato & Chris Burt (2023): “Liveness detection to take biometric adoption to new heights.”

- Biometric Update – Chris Burt (2025): “Innovatrics upgrades active biometric liveness detection with randomness, better UX.”

- 2025 Face Liveness Market Report & Buyer’s Guide – Biometric Update & Goode Intelligence

- Serve Legal (2024): “Addressing Gaps in the Facial Biometric Liveness Detection Testing Landscape.”