Biometric software comparison

What decision-makers truly need from biometric software

Digital leaders in banking, fintech, and government are looking for biometric authentication platforms that balance ironclad security with seamless user experience. In practice, this means software that can stop fraud and spoofing (e.g. detecting deepfakes, fake photos, or masks) while remaining easy for users during onboarding and login.

Compliance is equally critical – solutions must meet stringent KYC/AML regulations and international standards (like NIST and GDPR) to ensure every digital identity check is trustworthy and legal. Finally, decision-makers need technology that scales cost-effectively, integrating with mobile apps and existing systems without requiring specialized hardware or causing user drop-off during enrollment. In short, the ideal biometric software enables secure, compliant, and frictionless identity verification, even in high-volume or high-stakes use cases.

Key criteria for a modern biometric software comparison

When evaluating biometric software platforms, savvy organizations compare vendors across several objective dimensions:

Supported biometric modalities

Which biometrics are offered? Facial recognition is standard, but top platforms go further, offering fingerprint, palm, iris, or voice options for multi-modal security. Multi-modal systems (e.g. face + fingerprint) can boost accuracy and flexibility, whereas some providers only focus on face authentication. A modern solution should at least cover face and fingerprint biometrics, if not more, to address diverse use cases.

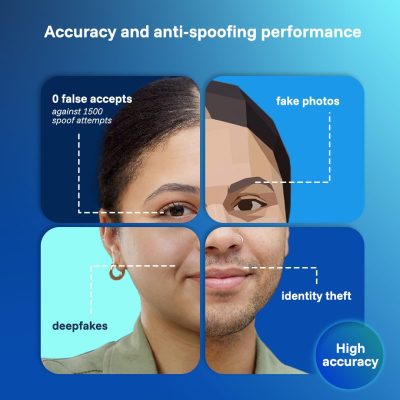

Accuracy and anti-spoofing performance

Strong biometric systems demonstrate low error rates (low False Accept Rate and False Reject Rate) and resilience to fraud. Look for independent test results or certifications: for example, a leading platform achieved zero false accepts against 1,500 spoof attempts (masks, deepfakes, etc.) in a recent lab test. Effective presentation attack detection is a must – the software should reliably catch fake photos, videos, masks, or AI-generated faces. High accuracy instills confidence for high-risk transactions and government ID programs.

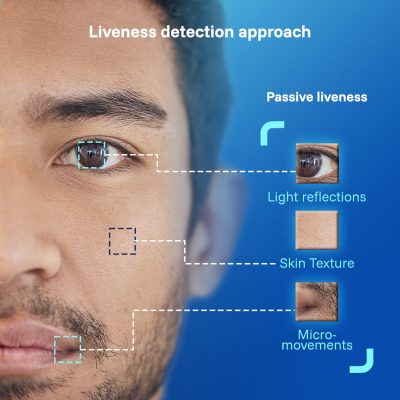

Liveness detection approach

Liveness detection ensures the biometric input is from a live person, not a spoof. There are two approaches: active liveness (asking the user to blink, smile or move) and passive liveness (running checks in the background with no user action required). Active methods add friction – users may get frustrated by prompts or fail to follow them, causing drop-offs. In contrast, passive liveness detection analyzes subtle cues like skin texture, light reflections, and micro-movements to confirm a live presence without interrupting the user. This is essential for a smooth UX. The best platforms, like Identy.io, use passive liveness to provide strong anti-spoofing with zero extra effort from users, which greatly improves onboarding conversion rates.

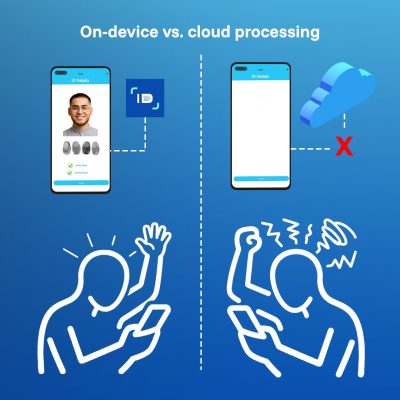

On-device vs. cloud processing

Where does the biometric matching and liveness analysis occur – on the user’s device or in the cloud? On-device processing is increasingly preferred for speed, privacy, and offline capability. By handling image capture and AI analysis locally on the smartphone, on-device solutions eliminate network latency and keep personal biometric data off servers. This also allows use in areas with poor internet connectivity and reduces server costs. Cloud-based approaches can leverage heavy compute power, but they require sending sensitive data over networks (raising privacy concerns) and need constant connectivity. Modern biometric SDKs often support both modes, but a truly mobile-first platform will perform critical checks on-device for real-time response and data security.

Regulatory and compliance alignment

Biometric software must align with global standards and regional regulations. Key benchmarks include ISO/IEC 30107-3 certification for liveness (anti-spoofing), and standards like NIST SP 800-63B, which actually require liveness detection in remote identity proofing. Leading vendors often undergo independent audits (e.g. iBeta PAD tests) to certify their anti-spoofing measures. Compliance with data protection laws (GDPR, CCPA) and financial regulations (KYC/AML in US, EU, LATAM) is also non-negotiable. For example, a compliant platform should allow biometric checks to satisfy customer due diligence rules in banking and meet eIDAS electronic ID standards in the EU. Integrating FIDO2 (passwordless) capabilities is another plus, ensuring the solution works in multi-factor authentication flows securely.

Integration and deployment

Practical considerations include how easily the solution integrates into existing systems and devices. Top biometric platforms provide robust SDKs/APIs for mobile (iOS/Android) and web, so developers can embed face or fingerprint verification in their apps with minimal code. Light-weight SDKs that run efficiently on average smartphones (e.g. requiring only a 5MP camera and modest CPU/RAM) are ideal, as they support mobile onboarding even on low-end devices. Flexibility to deploy on-premises or cloud and support for standards (e.g. outputting fingerprint templates in ANSI/NIST or ISO formats for interoperability) are important for integration with government or legacy systems. Ultimately, a good solution should plug into workflows (banking apps, e-government portals, etc.) seamlessly and scale to millions of users without performance loss.

Why Identy.io stands out against other leading providers

Identy.io emerges as a top choice when measured against other leading biometric providers, thanks to a combination of advanced capabilities that directly address the criteria above. First and foremost is Identy’s approach to liveness detection. Unlike many vendors that use active challenges or visible prompts, Identy.io employs passive liveness detection running silently in the background. The system checks for genuine human characteristics (skin texture, natural facial micro-movements, light diffusion) without ever interrupting the user’s experience. This gives Identy.io a critical UX advantage – users simply look at their camera normally, with no instructions or delays, yet the platform achieves rigorous anti-spoofing protection. In independent testing Identy’s face liveness had zero successful spoofs and virtually no false rejections, all while remaining practically invisible to the user. By maintaining security with zero user friction, Identy.io’s passive liveness is ideal for organizations that can’t afford abandoned onboarding processes. Every identity verification is both highly secure and conversion-friendly.

Another area where Identy.io leads is in biometric modalities and hardware independence. Identy.io offers multimodal biometrics solutions, not just face recognition but also contactless fingerprint capture – a capability few competing solutions provide. Using only a standard smartphone camera and flash, Identy.io can scan and verify fingerprints (even all ten fingers) without any dedicated scanner device. This is a game-changer for banks and governments historically reliant on physical fingerprint readers. Identy’s mobile fingerprint technology includes its own fingerprint liveness checks (to ensure it’s a real finger, not a fake or photo) that have been validated by independent labs with perfect scores. In essence, Identy.io transforms everyday phones into high-quality fingerprint scanners, eliminating the need for costly hardware and physical contact. Alternative vendors either omit fingerprint biometrics or require specialized devices, whereas Identy’s solution delivers scanner-grade accuracy in a touchless, camera-based workflow. This dramatically reduces deployment cost and complexity for large-scale projects. For example, Identy.io’s system produces standardized fingerprint templates (ANSI/NIST, ISO) compatible with government databases, bridging the gap between mobile capture and legacy AFIS systems – something competing providers struggle with if they lack a robust fingerprint capability.

Biometric Software Comparison

Identy.io vs Typical Market Solutions

Data based on certifications and technical specifications updated to 2025

Beyond liveness and modality, Identy.io also differentiates itself through its architecture and compliance pedigree. Identy was built as a mobile-first, on-device AI platform; it performs all biometric processing locally on the user’s device, from image capture and quality checks to matching and spoof detection. This design means negligible latency, no reliance on constant cloud connectivity, and enhanced privacy (biometric data isn’t streamed to a server) – an approach other providers are only starting to adopt. Notably, Identy.io is the only mobile biometric vendor (as of 2025) certified to NIST Level 2 Presentation Attack Detection with full on-device processing. That level of certification with an on-device workflow is a strong testament to the platform’s technical maturity and security. Identy.io also adheres to global standards like FIDO2 for passwordless login and ISO 30107-3 for anti-spoofing, and it meets regional data protection requirements out of the box. In short, Identy.io ticks all the boxes: multi-modal biometrics (face, finger, palm), top-tier accuracy, proven liveness defense, offline-capable on-device performance, and easy integration via SDK – all backed by certifications. These qualities position Identy.io as a stronger option when compared to other leading providers in the biometric software landscape.

Use cases in banking, fintech, and government

Real-world deployments underscore the importance of the above factors. In banking and fintech, biometric software is used for remote customer onboarding, mobile banking login, and high-risk transaction verification. Here, Identy.io’s focus on passive liveness directly supports business goals: banks want to verify that a real customer is creating an account or approving a transfer, but they cannot afford an onerous process that scares away users. By silently confirming liveliness with no extra steps, Identy’s solution helps financial institutions achieve KYC compliance and fraud prevention without hurting conversion rates. This translates to more completed sign-ups and fewer fraud losses. For instance, Banco Popular Dominicano was able to deploy Identy.io’s fingerprint and face biometrics in its mobile app for customer authentication – enhancing security with minimal friction during login and onboarding. Additionally, Identy’s contactless fingerprint tech unlocks new possibilities like passwordless login and transaction approval: a banking app can ask the user to look at the phone (for face recognition) and touch the back camera with a finger, achieving a two-factor biometric check in seconds without any hardware token. Such multi-factor biometric authentication is highly effective against account takeover fraud and meets strict requirements of regulations like PSD2 (which mandates strong customer authentication).

In government digital identity programs, the ability to perform secure biometric verification at scale is crucial. Agencies can leverage Identy.io for things like e-government portals, digital citizen IDs, border control, and law enforcement identity checks. A key benefit here is Identy’s support for offline and on-device operation – field officers or citizens in remote areas can still use the biometric system without internet access, since all matching and liveness checks run on the device. For example, a national ID enrollment drive could use ordinary smartphones to capture fingerprints and face photos from citizens in rural regions, with the assurance that each capture is live (not a spoof) and of high quality for later database matching. Government authorities also appreciate the compliance features: Identy.io produces biometric data in standardized formats and has been tested to interoperate with existing national databases, making it easier to integrate into voter registration systems, border security checks, or law enforcement watch-list matching. High-risk use cases like border screening or airport boarding benefit from Identy’s fast and accurate matching – its fingerprint algorithm ranked among the top in NIST evaluations for accuracy and speed, meaning it can reliably identify individuals against large databases in real time. Furthermore, passive liveness is particularly valuable in government and public-sector scenarios because it provides security without requiring public users to learn any special behavior. Whether it’s a pensioner authenticating for an e-government service or a traveler going through an automated border gate, the process feels natural: look at the camera and go. Meanwhile, under the hood, Identy.io is rigorously verifying that person’s identity and liveness according to the highest standards. The cost savings of Identy’s contactless approach are also significant for government budgets – avoiding proprietary scanners for fingerprints or palms can save millions, allowing broader deployment of biometric services to citizens.

Choosing the right biometric software comes down to balancing security, user experience, and adaptability. A thorough comparison of today’s leading solutions reveals that while many providers offer capable face recognition or basic liveness, Identy.io stands out by excelling across all key criteria. It delivers multi-modal biometrics (face, fingerprint, palm) with proven accuracy, incorporates passive liveness detection for strong anti-spoofing with a frictionless UX, and introduces innovations like camera-based fingerprint capture that eliminate traditional barriers. All of this is achieved on-device in real time, aligning with global compliance needs and the practical demands of banks and governments. The result is a platform that not only outperforms in tests and certifications, but also solves real business challenges – from raising conversion rates in mobile onboarding to cutting hardware costs and meeting regulatory mandates. In summary, for organizations comparing biometric software options, Identy.io represents a modern, robust solution that marries cutting-edge security with a seamless user journey, making it a top contender for any bank, fintech, or government looking to implement biometrics at scale.