Table of Contents

ToggleBiometric technologies are playing a central role in digital identity solutions, particularly in fintech and government. Understanding the distinction between biometric verification and biometric authentication is critical for CMOs, CTOs, and government leaders managing digital initiatives. Though often used interchangeably, these processes serve distinct purposes.

Biometric verification versus biometric authentication

What is biometric verification?

Biometric verification is the process of confirming an individual’s identity by comparing a biometric trait (such as a face or fingerprint) to a trusted source, typically an ID document. This one-time process is commonly used during onboarding. For instance, when a user opens an account, the system may compare their live selfie to the photo on their passport. If the match is confirmed, the system verifies the identity.

Verification emphasizes security and accuracy. Liveness detection is key it ensures the biometric sample comes from a real, live person and not a spoof. Standards like ISO/IEC 30107-3 address presentation attack detection, helping providers implement effective safeguards. Verification lays the foundation for trust, tying a person’s biometrics to a legal identity.

What is biometric authentication?

Authentication, on the other hand, is a repeated process. Once a user has been verified and enrolled, biometric authentication allows them to access services such as logging into an app by matching a live biometric sample to their stored template. It confirms that the same person is returning.

This one-to-one match must be fast and secure. Like verification, authentication also relies on liveness detection to prevent spoofing. NIST guidelines (e.g., SP 800-63) recommend combining biometrics with other authentication methods in high-risk scenarios. In fintech, this might mean using a facial scan plus device-level security for login.

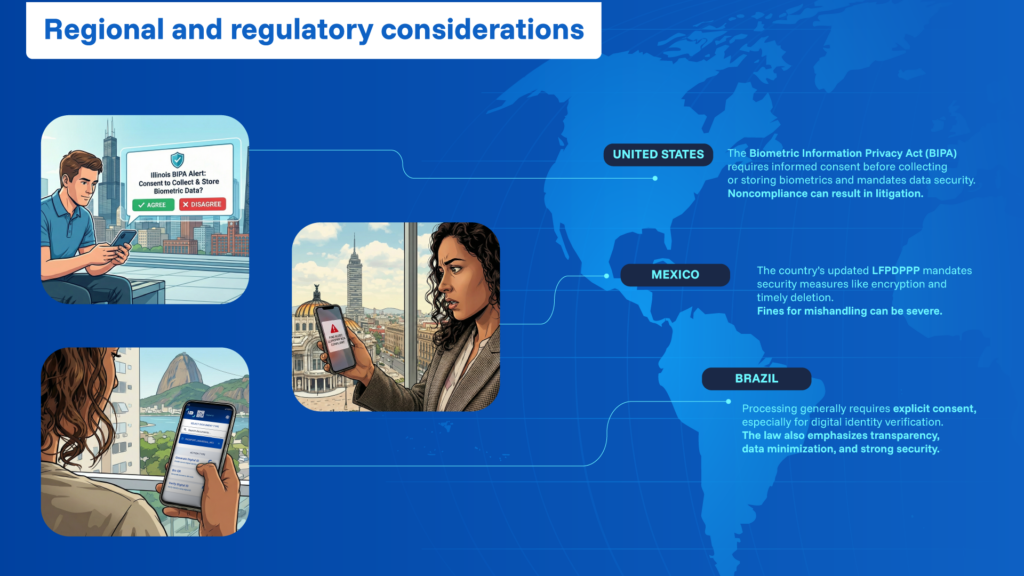

Regional and regulatory considerations

Biometrics in United States

While there’s no federal biometric law, guidelines from NIST influence identity practices. Some states, such as Illinois, have biometric-specific laws. The Biometric Information Privacy Act (BIPA) requires informed consent before collecting or storing biometrics and mandates data security. Noncompliance can result in litigation.

Biometrics in Brazil

Brazil’s LGPD treats biometric data as sensitive. Processing generally requires explicit consent, especially for digital identity verification. The law also emphasizes transparency, data minimization, and strong security. Organizations using biometrics must conduct impact assessments and protect data accordingly.

Biometrics in Mexico

Mexico’s updated LFPDPPP includes biometrics as sensitive personal data. Consent must be informed and specific. The law mandates security measures like encryption and timely deletion. Fines for mishandling can be severe, making compliance a priority for fintech and public services.

Biometric verification and authentication are distinct but complementary. Verification ties biometrics to a legal identity during onboarding. Authentication confirms that the returning user matches the original identity. For fintech and government services in the US, Brazil, and Mexico, implementing these tools requires attention to standards like ISO/IEC 30107 and NIST, and compliance with privacy laws like LGPD and LFPDPPP. Done right, biometrics offer a powerful blend of security and user experience.

- DLA Piper. “Data protection laws of the world: Brazil (LGPD).” Accessed 2025.

- TechTarget. “Biometric privacy and security challenges to know”

- ACLU Illinois. “Biometric information privacy act (BIPA)“