Table of Contents

ToggleBanks and fintechs are rapidly digitizing their services, making robust digital identity verification essential to prevent fraud and comply with regulations. As financial transactions move online, verifying that each customer is who they claim to be is crucial for meeting Know Your Customer (KYC) requirements and protecting against identity theft. For industry leaders, strong identity verification is not just about security it’s also a way to build customer trust in digital banking by ensuring every interaction is authentic and safe.

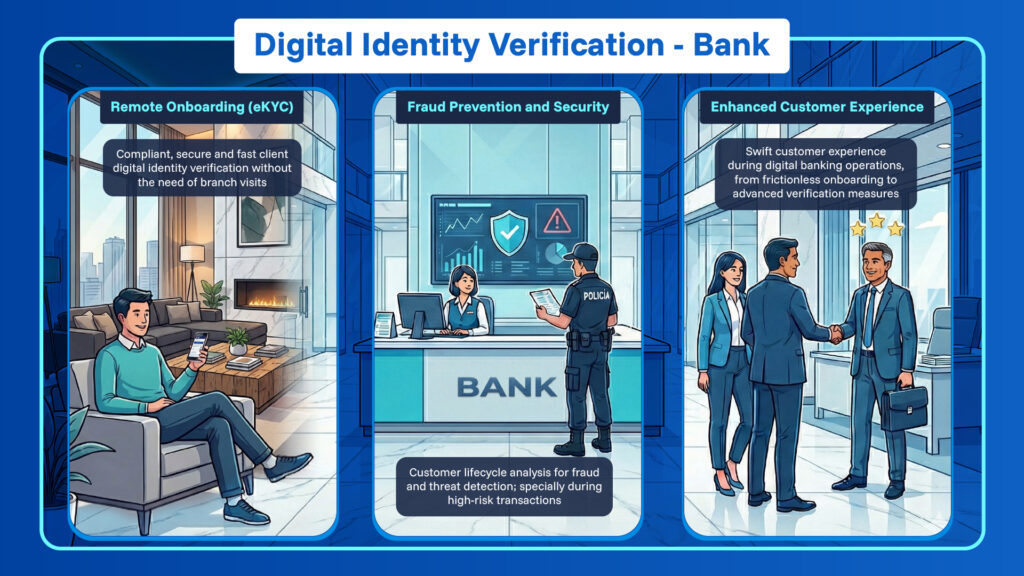

Banks are turning to specialized digital identity verification solutions to achieve secure, seamless verification. Identy.io, for example, provides a mobile-first biometric platform covering everything from remote onboarding (eKYC) to ongoing transaction authentication. Such advanced tools are trusted by major financial institutions to cut fraud and improve operational efficiency. They can verify a customer’s identity within seconds, keeping digital onboarding frictionless.

The importance of digital identity verification in banking

Banks cannot afford to neglect identity verification. Reported cases of fraudsters using stolen identities to open new bank accounts jumped by 32% in 2022, underscoring how gaps in verification can let fraud slip through. Such incidents lead to financial losses and erode customer trust.

Strict regulations make identity verification a non-negotiable duty for financial institutions. Global KYC and Anti-Money Laundering (AML) laws require banks to verify customers’ identities when opening accounts and beyond. Failing to comply can result in heavy penalties and reputational damage. Robust digital verification tools help banks meet these obligations efficiently, ensuring compliance while reinforcing security and credibility.

Use cases in banks and fintechs

Remote customer onboarding (eKYC)

Historically, opening a bank account meant presenting identification in person; today, digital identity verification enables remote onboarding. Banks can authenticate a new user’s identity by letting them upload a photo of their ID and a selfie through a secure app or web portal.

In 2024, Banco Popular Dominicano implemented Identy.io’s fingerprint biometric solution in its mobile applications, enabling secure user identity validation and eliminating the need to visit bank branches. This move reflects a broader trend in banking toward remote onboarding solutions that reduce friction while satisfying compliance requirements.

This electronic KYC process satisfies regulatory requirements for customer due diligence while eliminating the need for branch visits. It also speeds up onboarding banks can verify documents and biometrics within minutes, so new accounts are activated far faster than traditional methods. The result is a smooth, compliant first impression for new customers.

Fraud prevention and account security

Banks use digital identity verification across the customer lifecycle to prevent fraud. By analyzing identity data and behavior in real time, verification systems can flag suspicious sign-ups or login attempts before a breach occurs. For instance, if someone tries to open an account with stolen credentials, a robust platform will detect inconsistencies like mismatched photos or unusual devices and block the attempt. Similarly, verifying identities during high-risk transactions (like large transfers) adds a layer of security to prevent account takeovers and unauthorized access. These measures greatly reduce fraud losses and protect customers’ accounts.

Enhanced customer experience and trust

Beyond security and compliance, digital identity verification can improve the banking customer experience. Modern consumers expect to onboard and access services swiftly online, and verifying identity digitally allows this with minimal friction. Instead of waiting days for manual checks, customers can be approved in seconds, gaining instant access to their accounts. This convenience not only boosts satisfaction but also reinforces trust users feel safer knowing the bank is actively protecting their accounts with advanced verification measures.

Once seen as a back-office task, digital identity verification is now a strategic priority in banking. It enables compliant, fraud-proof onboarding and transactions, allowing banks to innovate digitally without compromising security. As threats evolve and regulations tighten, partnering with a trusted provider such as Identy.io gives banks advanced tools to verify identities in real time. Embracing these solutions means safer banking, satisfied customers, and stronger compliance.

- Thomson Reuters – “Identity verification: An in-depth overview.” Legal Insights, Oct 31, 2024.

- Biometrics Institute – “Identy Inc (Supplier Directory entry).” May 9, 2025.